What is a Navy Federal Auto Loan?

A Navy Federal Auto Loan is a financing option provided by Navy Federal Credit Union to help eligible members purchase new or used vehicles. Navy Federal Credit Union is a not-for-profit financial institution that serves members of the armed forces, veterans, and their families.

To be eligible for a Navy Federal Auto Loan, you must be a member of the credit union. Membership is open to active-duty military personnel, veterans, Department of Defense civilian employees, and their family members. Once you become a member, you can take advantage of the various financial products and services offered by Navy Federal, including auto loans.

Navy Federal Auto Loans offer several benefits to members:

-

Competitive Interest Rates: Navy Federal Credit Union typically offers lower interest rates on auto loans compared to traditional banks and other lenders. This can result in significant savings over the life of the loan.

-

Flexible Terms: Navy Federal provides flexible loan terms, allowing borrowers to choose repayment periods that fit their budget and financial situation. Loan terms can range from as short as 12 months to as long as 96 months (8 years).

-

No Hidden Fees: Navy Federal Auto Loans are known for their transparency and lack of hidden fees. Members can expect straightforward pricing without any surprises or additional costs.

-

Discounts and Rewards: Navy Federal often offers discounts and rewards to members who have multiple accounts or maintain good financial standing with the credit union. These benefits can further reduce the overall cost of the auto loan.

-

Personalized Service: As a credit union, Navy Federal prioritizes personalized service and member satisfaction. Members can expect attentive support throughout the auto loan process, from application to repayment.

By taking advantage of a Navy Federal Auto Loan, eligible members can enjoy competitive rates, flexible terms, and the benefits of working with a not-for-profit financial institution dedicated to serving the military community.

How Does the Navy Federal Auto Loan Calculator Work?

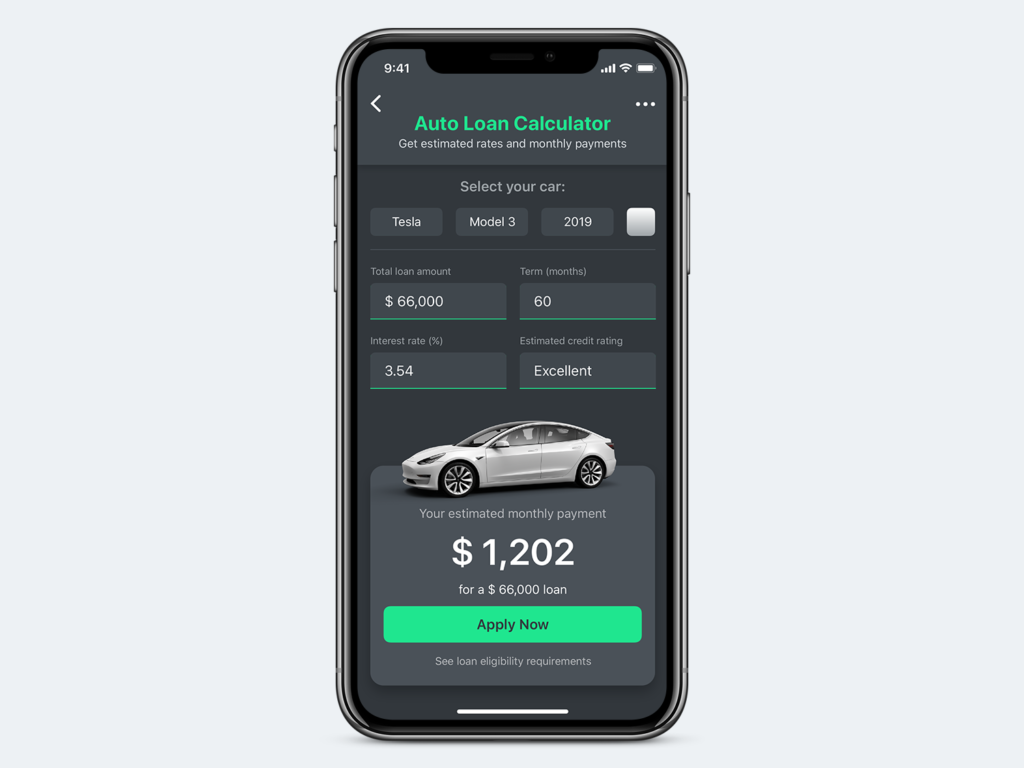

The Navy Federal Auto Loan Calculator is a powerful online tool designed to help you estimate your monthly car loan payments before applying for financing. Its primary purpose is to provide you with a clear understanding of how much you can expect to pay each month based on the loan amount, interest rate, and loan term you specify.

To use the calculator, you’ll need to provide a few key inputs:

-

Loan Amount: This is the total amount you plan to borrow for your vehicle purchase. You can adjust this figure to see how it impacts your monthly payments.

-

Interest Rate: The calculator allows you to enter the annual percentage rate (APR) for the auto loan. Navy Federal offers competitive rates, and you can experiment with different APRs to see how they affect your monthly payments.

-

Loan Term: This refers to the length of time over which you plan to repay the loan, typically ranging from 12 to 84 months. A longer loan term will result in lower monthly payments, but you’ll pay more in total interest over the life of the loan.

Once you’ve entered these three inputs, the calculator will crunch the numbers and provide you with an estimate of your monthly payment amount. It uses a standard amortization formula to determine how much of each payment will go towards the principal loan balance and how much will cover the interest charges.

By playing around with different loan amounts, interest rates, and loan terms, you can get a better sense of what monthly payment fits comfortably within your budget. This information can be invaluable when negotiating with dealers or exploring different financing options.

Factors Affecting Auto Loan Rates

Several factors influence the interest rate and monthly payments you’ll receive on a Navy Federal auto loan. Here are some key considerations:

Credit Score: Your credit score is one of the most significant determinants of your auto loan rate. Lenders use credit scores to assess the risk of lending to you. A higher credit score generally translates to a lower interest rate, as you’re viewed as a less risky borrower.

Loan Term: The loan term, or the length of time you have to repay the loan, can also impact your rate. Shorter loan terms (e.g., 36 months) typically have lower interest rates than longer terms (e.g., 72 months). However, shorter terms mean higher monthly payments.

Down Payment: A larger down payment can help you secure a lower interest rate. It demonstrates to the lender that you have more skin in the game and may be less likely to default on the loan.

Vehicle Type: The type of vehicle you’re financing can also play a role. Loans for new vehicles generally have lower rates than used vehicles, as new cars are less risky investments for lenders.

Debt-to-Income Ratio: Lenders will consider your debt-to-income ratio, which is the percentage of your monthly gross income that goes toward paying debts. A lower debt-to-income ratio can help you qualify for better rates.

Loan Amount: In some cases, borrowing a larger amount may result in a slightly higher interest rate, as the lender is taking on more risk.

By understanding these factors, you can better position yourself to qualify for the most favorable auto loan rates from Navy Federal Credit Union.

Using the Navy Federal Auto Loan Calculator

The Navy Federal Auto Loan Calculator is a user-friendly tool designed to help you estimate your monthly payments and overall loan costs for purchasing a new or used vehicle. To use the calculator, follow these simple steps:

-

Enter the Vehicle Price: Start by entering the purchase price of the vehicle you’re interested in. This should include any additional fees or taxes, if applicable.

-

Specify the Down Payment: Next, enter the amount you plan to put down as a down payment. A larger down payment can lower your monthly payments and overall interest costs.

-

Select the Loan Term: Choose the loan term or the number of months you wish to finance the vehicle. Navy Federal typically offers terms ranging from 12 to 84 months.

-

Input the Interest Rate: Enter the annual percentage rate (APR) you expect to receive on your auto loan. If you’re unsure, you can use Navy Federal’s current advertised rates or estimate based on your credit score.

-

Optional: Include Trade-In Value: If you have a vehicle to trade in, you can enter its estimated value. This amount will be deducted from the total loan amount.

-

Calculate: Once you’ve entered all the necessary information, click the “Calculate” button to generate your estimated monthly payment and total interest costs.

The calculator will provide you with the following results:

- Monthly Payment: This is the amount you’ll need to pay each month for the duration of the loan term.

- Total Interest Paid: This represents the total amount of interest you’ll pay over the life of the loan.

- Total Cost of Loan: This is the sum of the vehicle’s purchase price and the total interest paid, giving you the overall cost of financing the vehicle.

By adjusting the input values, such as the down payment amount, loan term, or interest rate, you can see how these factors impact your monthly payments and total costs. This can help you determine the most affordable and suitable loan option for your budget and financial situation.

Comparing Loan Options

The Navy Federal Auto Loan Calculator is a powerful tool that allows you to compare multiple loan scenarios side by side. This feature is particularly useful when you’re considering different loan terms, interest rates, or down payment amounts. By inputting various combinations of these factors, you can analyze how they impact your monthly payments, total interest paid, and overall loan cost.

To compare loan options, start by entering the vehicle’s purchase price and your desired down payment amount. Then, adjust the loan term (e.g., 36 months, 48 months, 60 months) and the interest rate to see how these variables affect your monthly payment and total interest paid. You can also experiment with different down payment amounts to understand how a larger or smaller upfront investment impacts your long-term loan costs.

The calculator will display the results for each scenario side by side, making it easy to compare and contrast the different options. Pay close attention to the total interest paid over the life of the loan, as this can vary significantly depending on the loan term and interest rate.

By comparing multiple loan scenarios, you can make an informed decision that aligns with your budget and financial goals. For example, if you prioritize lower monthly payments, a longer loan term may be more appealing, even though it will result in higher total interest paid. Conversely, if minimizing interest costs is your primary concern, a shorter loan term with a higher monthly payment may be the better choice.

Remember, the Navy Federal Auto Loan Calculator is a tool to help you evaluate your options, but it’s always a good idea to consult with a loan officer or financial advisor to ensure you fully understand the terms and implications of your loan agreement.

Understanding Loan Terms

When taking out an auto loan, it’s essential to understand the various terms and their impact on your overall costs. Here are some common loan terms you’ll encounter:

Annual Percentage Rate (APR): The APR represents the total cost of borrowing money, including interest and any additional fees. A higher APR translates to higher interest charges over the life of the loan. It’s crucial to compare APRs when shopping for an auto loan, as even a small difference can significantly impact your long-term costs.

Loan Term: The loan term refers to the length of time you have to repay the loan, typically ranging from 24 to 84 months (2 to 7 years). Longer loan terms mean lower monthly payments, but you’ll end up paying more in interest over the life of the loan. Shorter loan terms have higher monthly payments but result in less interest paid overall.

Amortization:

Amortization is the process of spreading out the loan repayment over the loan term. In the early stages of the loan, a larger portion of your monthly payment goes toward interest charges, while in the later stages, more of the payment is applied to the principal balance. Understanding amortization can help you make informed decisions about loan terms and potential prepayments.

Principal Balance: The principal balance is the amount of money you initially borrowed and have yet to repay. As you make monthly payments, a portion of each payment goes toward reducing the principal balance.

Interest Charges: Interest charges are the fees you pay to the lender for borrowing money. They are calculated based on the outstanding principal balance and the APR. The higher the APR and the longer the loan term, the more you’ll pay in interest charges over the life of the loan.

By understanding these loan terms, you can better evaluate the true cost of an auto loan and make an informed decision that aligns with your financial goals and budget.

Down Payment Considerations

Making a larger down payment when purchasing a vehicle can significantly reduce the overall costs associated with an auto loan. A higher down payment means you’ll need to borrow less money, resulting in lower interest charges over the life of the loan. Additionally, a substantial down payment can help you secure a lower interest rate, as lenders view borrowers with more skin in the game as lower risks.

The Navy Federal Auto Loan Calculator allows you to input different down payment amounts to see the impact on your monthly payments and overall loan costs. By increasing the down payment, you’ll notice a decrease in the total interest paid and the overall amount financed. This can be a valuable tool in determining how much you should save for a down payment to keep your auto loan costs manageable.

It’s generally recommended to put down at least 10-20% of the vehicle’s purchase price as a down payment. However, if you can afford a larger down payment, such as 30% or more, you’ll see even greater savings on interest charges and a lower overall loan cost. Just keep in mind that a larger down payment means tying up more of your cash upfront, so you’ll need to balance your budget and savings goals accordingly.

Loan Pre-Approval Process

Getting pre-approved for a Navy Federal auto loan can streamline the car-buying process and give you a better understanding of your budget. Here are the typical steps to obtain pre-approval:

-

Gather Required Documents: You’ll need to provide personal information, employment details, income verification (such as pay stubs or tax returns), and proof of residence. Having these documents ready can expedite the pre-approval process.

-

Check Your Credit Score: Navy Federal will review your credit history and score to determine your eligibility and potential interest rates. Checking your credit score beforehand can help you understand where you stand and address any issues if needed.

-

Complete the Pre-Approval Application: You can apply for pre-approval online, over the phone, or at a Navy Federal branch. Provide the required information and documentation.

-

Review Pre-Approval Terms: If approved, Navy Federal will provide you with a pre-approval letter outlining the maximum loan amount, interest rate, and other terms based on your creditworthiness and income.

-

Shop for Your Vehicle: With pre-approval in hand, you can confidently search for your desired vehicle within your approved budget, knowing the financing is already in place.

The benefits of getting pre-approved include a smoother negotiation process with dealers, as you’ll be seen as a cash buyer, and the ability to lock in a favorable interest rate for a specified period (typically 30-60 days). Pre-approval also allows you to focus your search on vehicles within your approved budget, saving time and effort.

Refinancing an Existing Auto Loan

Refinancing an existing auto loan can be a smart financial move if you’re able to secure a lower interest rate or better terms. The Navy Federal Auto Loan Calculator can be a valuable tool in determining whether refinancing is worth considering.

When refinancing, the calculator allows you to input your current loan details, including the remaining balance, interest rate, and term. You can then compare these figures with potential new loan terms offered by Navy Federal Credit Union. The calculator will provide an estimate of your potential monthly savings and the total interest you could save over the life of the new loan.

To qualify for refinancing with Navy Federal, you’ll typically need to meet the following requirements:

- Loan Age: Your existing auto loan must be at least 6 months old.

- Vehicle Age and Mileage: The vehicle’s age and mileage must fall within Navy Federal’s guidelines, which vary depending on the make, model, and year.

- Credit Score: A good to excellent credit score will increase your chances of qualifying for the best rates.

- Loan-to-Value Ratio: Navy Federal may have specific loan-to-value ratio requirements, which consider the vehicle’s value in relation to the loan amount.

Refinancing can be particularly advantageous if your credit score has improved significantly since you took out your original loan, as this could qualify you for a lower interest rate. Additionally, if market rates have dropped, refinancing could help you save on interest charges over the remaining term of your loan.

However, it’s important to consider any potential fees associated with refinancing, such as prepayment penalties or origination fees charged by the new lender. The Navy Federal Auto Loan Calculator can help you weigh these costs against the potential savings to determine if refinancing is a financially sound decision.

Tips for Getting the Best Rates

Getting the best rates on your Navy Federal auto loan can save you thousands of dollars over the life of the loan. Here are some tips to help you secure the most favorable terms:

Improve Your Credit Score

Your credit score is one of the primary factors lenders consider when determining your interest rate. A higher credit score generally qualifies you for lower rates. Pay all your bills on time, keep credit card balances low, and avoid opening too many new credit accounts at once to improve your score.

Shop Around

Don’t just settle for the first auto loan offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders. Even a small difference in the interest rate can add up to significant savings over the loan term.

Negotiate

Lenders often have some flexibility with their rates, especially if you have a strong credit profile. Don’t be afraid to negotiate for a better rate, especially if you have competing offers from other lenders.

Utilize Discounts and Incentives

Many lenders offer discounts or incentives for certain borrowers, such as members of the military or those who set up automatic payments. Be sure to ask about any available discounts that could lower your rate.

Consider a Shorter Loan Term

While a longer loan term may result in a lower monthly payment, it will also mean paying more in interest over the life of the loan. A shorter loan term, such as 36 or 48 months, can save you a significant amount in interest charges.

Make a Larger Down Payment

Putting more money down can not only lower your monthly payments but may also qualify you for a better interest rate. Lenders view borrowers with more skin in the game as lower risk.

By following these tips, you can increase your chances of securing the best possible rates on your Navy Federal auto loan, saving you money and making your car purchase more affordable.

Navy Federal Auto Loan Benefits

Navy Federal Credit Union offers several benefits to members who finance their auto purchases through the credit union. In addition to competitive rates and flexible terms, Navy Federal provides valuable car-buying services and discounts to make the process more convenient and cost-effective.

One of the standout benefits is the Navy Federal Car Buying Service, which allows members to research vehicles, get pre-qualified for financing, and even receive upfront pricing on new and used cars from participating dealers. This service takes the hassle out of negotiating and can potentially save members thousands of dollars on their purchase.

Furthermore, Navy Federal partners with various retailers and service providers to offer exclusive discounts and savings to members. These discounts can apply to auto parts, maintenance services, car rentals, and even insurance premiums. By bundling these perks with their auto loan, members can potentially save a significant amount of money over the life of their vehicle ownership.

Another valuable benefit is the option to add guaranteed asset protection (GAP) coverage to your auto loan. This coverage helps bridge the gap between your loan balance and your vehicle’s actual cash value in the event of a total loss. GAP coverage can provide valuable financial protection and peace of mind for Navy Federal members.

Navy Federal also offers

Navy Federal also offers convenient payment options, including automatic loan payments from your Navy Federal account, online payments, and even the ability to make payments through the Navy Federal mobile app. This flexibility can help members stay on top of their auto loan payments and avoid late fees or penalties.

Overall, the benefits of financing an auto purchase through Navy Federal Credit Union extend beyond just competitive rates and terms. The car-buying services, exclusive discounts, and additional protection options can make the entire process more streamlined, cost-effective, and convenient for Navy Federal members.

Applying for a Navy Federal Auto Loan

Applying for a Navy Federal auto loan is a straightforward process that can be completed online, over the phone, or at a local branch. Here are the typical steps involved:

-

Gather Required Documents: You’ll need to provide some personal and financial information, including your name, address, Social Security number, employment details, and income information. If you’re purchasing a new vehicle, you’ll also need the vehicle’s details, such as the make, model, year, and sale price.

-

Pre-Approval (Optional): Navy Federal offers a pre-approval process, which can be beneficial if you’re still shopping for a vehicle. This allows you to know your approved loan amount and estimated interest rate before you start negotiating with dealers.

Complete the Application:

-

You can apply online, over the phone, or in person at a Navy Federal branch. The application process typically takes around 15-30 minutes to complete, depending on how prepared you are with the required information.

-

Submit Additional Documentation: Depending on your specific situation, Navy Federal may request additional documentation, such as proof of income (e.g., pay stubs, tax returns), proof of residence, or proof of insurance.

-

Loan Approval and Disclosures: Once your application is reviewed and approved, Navy Federal will provide you with the final loan terms, including the interest rate, monthly payment, and any fees or charges. You’ll need to review and accept these terms before proceeding.

-

Funding and Vehicle Purchase: If you’re purchasing a new vehicle, Navy Federal will work with the dealership to facilitate the purchase and transfer of funds. If you’re refinancing an existing loan or purchasing a used vehicle from a private party, Navy Federal will provide you with instructions on how to complete the transaction and disburse the loan funds.

The entire process, from application to funding, typically takes 1-2 weeks for most borrowers. However, the timeline can vary depending on factors such as the completeness of your application, the need for additional documentation, and the complexity of your loan scenario.

Auto Loan Calculator Limitations

While the Navy Federal Auto Loan Calculator is a valuable tool for estimating your monthly payments and overall loan costs, it’s important to understand its limitations. The calculator provides an estimate based on the information you provide, but it cannot account for all the variables and specific circumstances that may affect your actual loan terms and rates.

First and foremost, the calculator’s results should be treated as estimates, not guaranteed figures. The actual interest rate, loan amount, and monthly payment may vary depending on factors such as your credit score, income, debt-to-income ratio, and the vehicle’s value, among others.

Additionally, the calculator may not consider certain fees or charges that could be associated with your loan, such as documentation fees, title fees, or prepayment penalties. These additional costs can impact the overall cost of your loan and should be discussed with a Navy Federal loan officer.

It’s also important to note that the calculator’s results are based on the information you provide, and any inaccuracies or changes in your financial situation could affect the actual loan terms you receive.

While the Navy Federal Auto Loan Calculator is a useful tool for initial planning and budgeting, it should not be solely relied upon for making a final decision. It’s crucial to verify the calculator’s results with a Navy Federal loan officer, who can provide you with a more accurate and personalized assessment based on your specific financial situation and loan requirements.

Additional Auto Loan Resources

When exploring auto loan options, it’s beneficial to consult various resources to make an informed decision. Consider reviewing comprehensive auto loan guides that provide in-depth explanations of the lending process, terminology, and factors to consider. Financial advice blogs can offer valuable insights, tips, and strategies for securing favorable loan terms and managing your auto financing effectively.

Additionally, online comparison tools can be handy for evaluating different lenders, interest rates, and loan structures side by side. These tools often allow you to input your specific criteria and preferences, making it easier to identify the best fit for your needs. Some reputable personal finance websites and credit unions may also offer auto loan calculators and educational resources tailored to your local area or specific circumstances.

Remember, while online resources can be incredibly helpful, it’s always advisable to consult with a financial advisor or lender representative for personalized guidance and to address any specific concerns or questions you may have throughout the auto loan process.